Lowest Property Tax Rate In Illinois . The county, which sits to the north of chicago, has an average. Web the illinois counties with the lowest effective property tax rates are pope county (1.16%), pulaski county (1.17%), and hardin county (1.37%). This interactive table ranks illinois' counties by median property tax in. Web illinois has 102 counties, with median property taxes ranging from a high of $6,285.00 in lake county to a low of. Median property tax is $3,507.00. Web there are exactly 102 counties that makeup illinois and your property tax rate will vary based on the one you choose to live in. Web 2022 number of taxing districts in illinois: 4.5/5 (93k) Web if you are looking for low property taxes in illinois, lake county may not be the best choice. Web the average state property tax rate in illinois is 2.31%, according to data from smartasset. Web 103 rows illinois : 2022 number of general homestead exemptions and the.

from www.reallylist.com

Web the illinois counties with the lowest effective property tax rates are pope county (1.16%), pulaski county (1.17%), and hardin county (1.37%). Web the average state property tax rate in illinois is 2.31%, according to data from smartasset. The county, which sits to the north of chicago, has an average. This interactive table ranks illinois' counties by median property tax in. Median property tax is $3,507.00. Web if you are looking for low property taxes in illinois, lake county may not be the best choice. Web 2022 number of taxing districts in illinois: Web there are exactly 102 counties that makeup illinois and your property tax rate will vary based on the one you choose to live in. 2022 number of general homestead exemptions and the. 4.5/5 (93k)

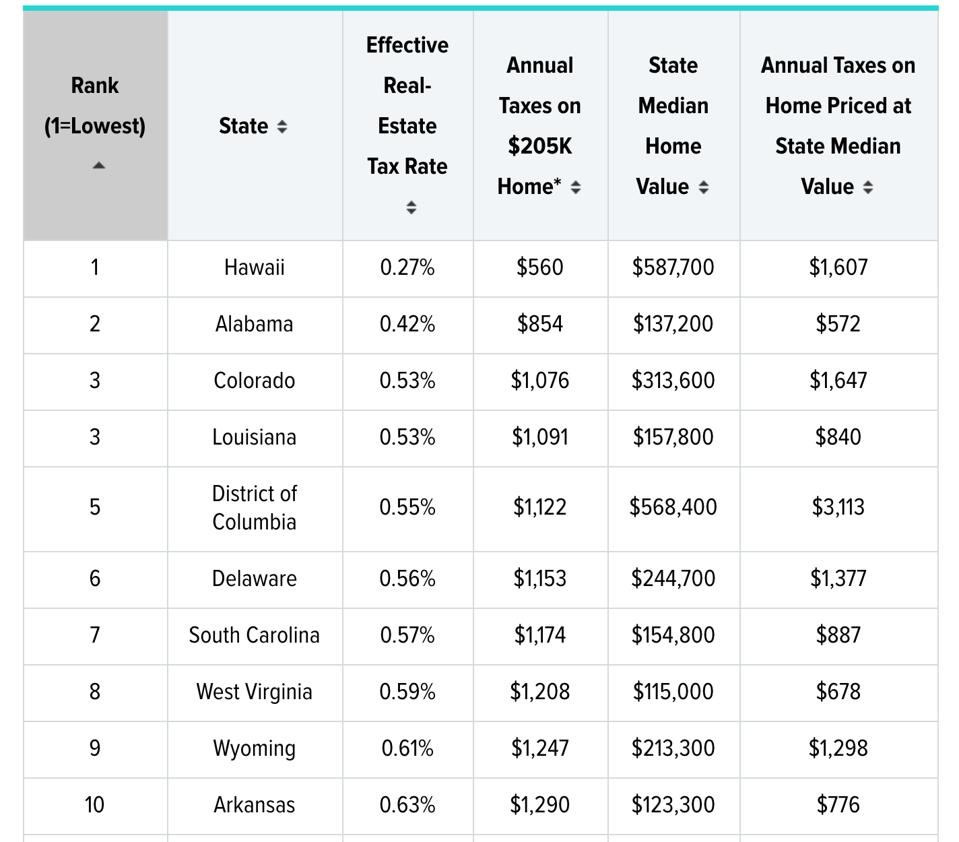

2020 Report Ranks U.S. Property Taxes By State

Lowest Property Tax Rate In Illinois Median property tax is $3,507.00. 4.5/5 (93k) This interactive table ranks illinois' counties by median property tax in. Web the illinois counties with the lowest effective property tax rates are pope county (1.16%), pulaski county (1.17%), and hardin county (1.37%). 2022 number of general homestead exemptions and the. The county, which sits to the north of chicago, has an average. Web if you are looking for low property taxes in illinois, lake county may not be the best choice. Web illinois has 102 counties, with median property taxes ranging from a high of $6,285.00 in lake county to a low of. Web the average state property tax rate in illinois is 2.31%, according to data from smartasset. Web 103 rows illinois : Web there are exactly 102 counties that makeup illinois and your property tax rate will vary based on the one you choose to live in. Median property tax is $3,507.00. Web 2022 number of taxing districts in illinois:

From www.ezhomesearch.com

The States With the Lowest Real Estate Taxes in 2023 Lowest Property Tax Rate In Illinois 4.5/5 (93k) Web there are exactly 102 counties that makeup illinois and your property tax rate will vary based on the one you choose to live in. 2022 number of general homestead exemptions and the. Web the illinois counties with the lowest effective property tax rates are pope county (1.16%), pulaski county (1.17%), and hardin county (1.37%). The county,. Lowest Property Tax Rate In Illinois.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet Lowest Property Tax Rate In Illinois This interactive table ranks illinois' counties by median property tax in. Web 103 rows illinois : Web 2022 number of taxing districts in illinois: 2022 number of general homestead exemptions and the. Web the average state property tax rate in illinois is 2.31%, according to data from smartasset. Web there are exactly 102 counties that makeup illinois and your property. Lowest Property Tax Rate In Illinois.

From myemail.constantcontact.com

does your state impose high taxes? Lowest Property Tax Rate In Illinois Web if you are looking for low property taxes in illinois, lake county may not be the best choice. Median property tax is $3,507.00. Web 2022 number of taxing districts in illinois: Web the average state property tax rate in illinois is 2.31%, according to data from smartasset. Web there are exactly 102 counties that makeup illinois and your property. Lowest Property Tax Rate In Illinois.

From decaturtax.blogspot.com

Decatur Tax Blog median property tax rate Lowest Property Tax Rate In Illinois The county, which sits to the north of chicago, has an average. Web 2022 number of taxing districts in illinois: Web the average state property tax rate in illinois is 2.31%, according to data from smartasset. Web there are exactly 102 counties that makeup illinois and your property tax rate will vary based on the one you choose to live. Lowest Property Tax Rate In Illinois.

From realestateinvestingtoday.com

Which States have the Highest & Lowest Property Taxes? Real Estate Lowest Property Tax Rate In Illinois 4.5/5 (93k) Web the illinois counties with the lowest effective property tax rates are pope county (1.16%), pulaski county (1.17%), and hardin county (1.37%). Web if you are looking for low property taxes in illinois, lake county may not be the best choice. Web illinois has 102 counties, with median property taxes ranging from a high of $6,285.00 in. Lowest Property Tax Rate In Illinois.

From www.buyhomesincharleston.com

How Property Taxes Can Impact Your Mortgage Payment Lowest Property Tax Rate In Illinois 4.5/5 (93k) The county, which sits to the north of chicago, has an average. Median property tax is $3,507.00. Web the average state property tax rate in illinois is 2.31%, according to data from smartasset. Web 103 rows illinois : Web there are exactly 102 counties that makeup illinois and your property tax rate will vary based on the. Lowest Property Tax Rate In Illinois.

From www.chicagobusiness.com

Chicago property taxes rise nearly 7 in 2023 tax year Crain's Juice Lowest Property Tax Rate In Illinois 4.5/5 (93k) Web the average state property tax rate in illinois is 2.31%, according to data from smartasset. 2022 number of general homestead exemptions and the. Web 103 rows illinois : Median property tax is $3,507.00. Web illinois has 102 counties, with median property taxes ranging from a high of $6,285.00 in lake county to a low of. This. Lowest Property Tax Rate In Illinois.

From www.armstrongeconomics.com

US Property Tax Comparison by State Armstrong Economics Lowest Property Tax Rate In Illinois Median property tax is $3,507.00. The county, which sits to the north of chicago, has an average. Web if you are looking for low property taxes in illinois, lake county may not be the best choice. Web the illinois counties with the lowest effective property tax rates are pope county (1.16%), pulaski county (1.17%), and hardin county (1.37%). 2022 number. Lowest Property Tax Rate In Illinois.

From www.biggerpockets.com

States With The Lowest Property Taxes In 2023 Lowest Property Tax Rate In Illinois 2022 number of general homestead exemptions and the. Web there are exactly 102 counties that makeup illinois and your property tax rate will vary based on the one you choose to live in. Web 103 rows illinois : Web the illinois counties with the lowest effective property tax rates are pope county (1.16%), pulaski county (1.17%), and hardin county (1.37%).. Lowest Property Tax Rate In Illinois.

From cloqnichol.pages.dev

2024 State Tax Adena Brunhilde Lowest Property Tax Rate In Illinois Web 103 rows illinois : Web the average state property tax rate in illinois is 2.31%, according to data from smartasset. Web 2022 number of taxing districts in illinois: This interactive table ranks illinois' counties by median property tax in. 2022 number of general homestead exemptions and the. 4.5/5 (93k) Median property tax is $3,507.00. Web there are exactly. Lowest Property Tax Rate In Illinois.

From www.chicagomag.com

Illinois Now Has the SecondHighest Property Taxes in the Nation Lowest Property Tax Rate In Illinois 4.5/5 (93k) Web if you are looking for low property taxes in illinois, lake county may not be the best choice. Web the illinois counties with the lowest effective property tax rates are pope county (1.16%), pulaski county (1.17%), and hardin county (1.37%). Web illinois has 102 counties, with median property taxes ranging from a high of $6,285.00 in. Lowest Property Tax Rate In Illinois.

From alaskapolicyforum.org

Alaska’s Property Taxes, Ranked Alaska Policy Forum Lowest Property Tax Rate In Illinois This interactive table ranks illinois' counties by median property tax in. Web the illinois counties with the lowest effective property tax rates are pope county (1.16%), pulaski county (1.17%), and hardin county (1.37%). Web 2022 number of taxing districts in illinois: 2022 number of general homestead exemptions and the. Web the average state property tax rate in illinois is 2.31%,. Lowest Property Tax Rate In Illinois.

From sparkrental.com

Property Taxes by State & County Lowest Property Taxes in the US Mapped Lowest Property Tax Rate In Illinois Web 103 rows illinois : Web if you are looking for low property taxes in illinois, lake county may not be the best choice. Web illinois has 102 counties, with median property taxes ranging from a high of $6,285.00 in lake county to a low of. Median property tax is $3,507.00. Web the average state property tax rate in illinois. Lowest Property Tax Rate In Illinois.

From www.taxmypropertyfairly.com

Upstate NY Has Some of the Highest Property Tax Rates in the Nation Lowest Property Tax Rate In Illinois Web if you are looking for low property taxes in illinois, lake county may not be the best choice. Web illinois has 102 counties, with median property taxes ranging from a high of $6,285.00 in lake county to a low of. 2022 number of general homestead exemptions and the. The county, which sits to the north of chicago, has an. Lowest Property Tax Rate In Illinois.

From www.cerescourier.com

Company rates Stanislaus County in top 10 where property taxes go Lowest Property Tax Rate In Illinois Web there are exactly 102 counties that makeup illinois and your property tax rate will vary based on the one you choose to live in. Web the average state property tax rate in illinois is 2.31%, according to data from smartasset. The county, which sits to the north of chicago, has an average. Web 2022 number of taxing districts in. Lowest Property Tax Rate In Illinois.

From learningfullcaveman.z21.web.core.windows.net

Property Tax Information For Taxes Lowest Property Tax Rate In Illinois Web illinois has 102 counties, with median property taxes ranging from a high of $6,285.00 in lake county to a low of. Web there are exactly 102 counties that makeup illinois and your property tax rate will vary based on the one you choose to live in. Web 2022 number of taxing districts in illinois: 4.5/5 (93k) Web if. Lowest Property Tax Rate In Illinois.

From janelqalverta.pages.dev

Minimum To File Taxes 2024 In Illinois Usa Nedi Gayleen Lowest Property Tax Rate In Illinois This interactive table ranks illinois' counties by median property tax in. Web the average state property tax rate in illinois is 2.31%, according to data from smartasset. 2022 number of general homestead exemptions and the. Web 2022 number of taxing districts in illinois: The county, which sits to the north of chicago, has an average. Web the illinois counties with. Lowest Property Tax Rate In Illinois.

From www.nationalmortgagenews.com

24 states with the lowest property taxes National Mortgage News Lowest Property Tax Rate In Illinois 2022 number of general homestead exemptions and the. This interactive table ranks illinois' counties by median property tax in. Web 2022 number of taxing districts in illinois: Web the average state property tax rate in illinois is 2.31%, according to data from smartasset. The county, which sits to the north of chicago, has an average. Web the illinois counties with. Lowest Property Tax Rate In Illinois.